Nothing I’ve ever done (in terms of effort and soul) in life has been wasted. Something of value always accrued to me when I made the sacrifices necessary to do something worthwhile.

- Jordan Peterson

Alongside laying the foundations for long-term investing, I day traded for 3 years in college hoping to accelerate my wealth journey. Every evening from 8pm till around 3am, I was glued to the screen trading the NY stock exchange hours. The next day, I’d analyse stats and refine my edge in the morning. While my peers were out living the typical college life, I was buried in charts and excel sheets. I remember once skipping a date with a hot Korean girl because a monstrous high-conviction trade setup had formed.

Let’s address the elephant in the room - day trading works. I’ve learnt that it is possible to backtest and find a reliable and repeatable edge in the market. The reason why I failed was because commissions and fees ate too much into my edge, and over time, they led to losses. It also demands huge amounts of focus and attention that I couldn’t give once I started working.

Below are my biggest takeaways from 3 years of day trading. Even if you never touch a trading platform, I hope these insights will help in your investing journey.

Overcoming stress and fear

I met my first trading mentor through a mutual friend. He introduced me to a few setups passed down from a European billionaire and got me started with paper trading. Once I was consistent, I began risking real money, around $5 to $10 per trade.

Paper trading was a breeze, but the moment I had real money on the line, my pulse would spike through the roof. My palms would sweat, my chest tighten and I felt as if my heart would smash through my ribcage at some point. I confided in my close friends that I thought day trading was a health hazard. Surely spiking my cortisol levels couldn’t be good for my longevity.

But then fortuitously, I read The Upside of Stress by Kelly McGonigal, who identified two kinds of stress: distress, which overwhelms, and eustress, which challenges and strengthens us. She describes the “challenge response” as a form of stress that boosts focus, motivation, and confidence, especially when the stressor is voluntary and purpose-driven.

Voluntarily stepping into trades became a kind of inoculation where each trade reduced my sensitivity to risk. As I adapted, my risk tolerance increased, and I needed bigger and bigger trades to feel the same levels of excitement.

This gradual process of desensitization I think was one of the most valuable life skills I’ve taken away from trading. Today I can place and manage investments, accept leverage as a structural part of my life, and take risks while feeling absolutely nothing. The spillover effects of emotional detachment carry over to long-term investing and other areas of life.

Choosing your mentors

After a few months, my trading mentor suddenly disappeared. Later, I heard he had taken a massive dose of LSD and dissolved his sense of self. I lost my mentor and the structured progression of my trading plan.

I had to pivot to find a new mentor. But finding someone genuine to teach you is incredibly hard. The internet is a minefield of hucksters, frauds, and charlatans all trying to sell you a dream and cash out before you're any wiser. So how do you separate the real traders from the grifters? Turns out, it’s actually pretty simple:

They give out their content for free

They’re committed to the pursuit of truth

The first is self explanatory. Any trader who has found genuine success doesn’t need to sell you a course (there are exceptions to this rule, though). The second, I think is more important and requires a deeer dive.

Successful investors and traders often share a specific psychological profile: high openness, low agreeableness. They aren’t afraid to offend. They value truth over consensus. This makes them rare, because most people filter the world through emotion and subjectivity, what “feels” true, rather than what is true.

But truth-seekers are easy to spot. You see it in their writing, in how they frame arguments, in their relentless wrestling with reality. They clarify rather than confuse. In short: male-pattern autism is one of the most reliable indicators of intellectual honesty.

The most reputable traders I’ve found based on the above framework are:

@TradetheMatrix1

@Qullamaggie

@pakpakchicken

Building a trading system

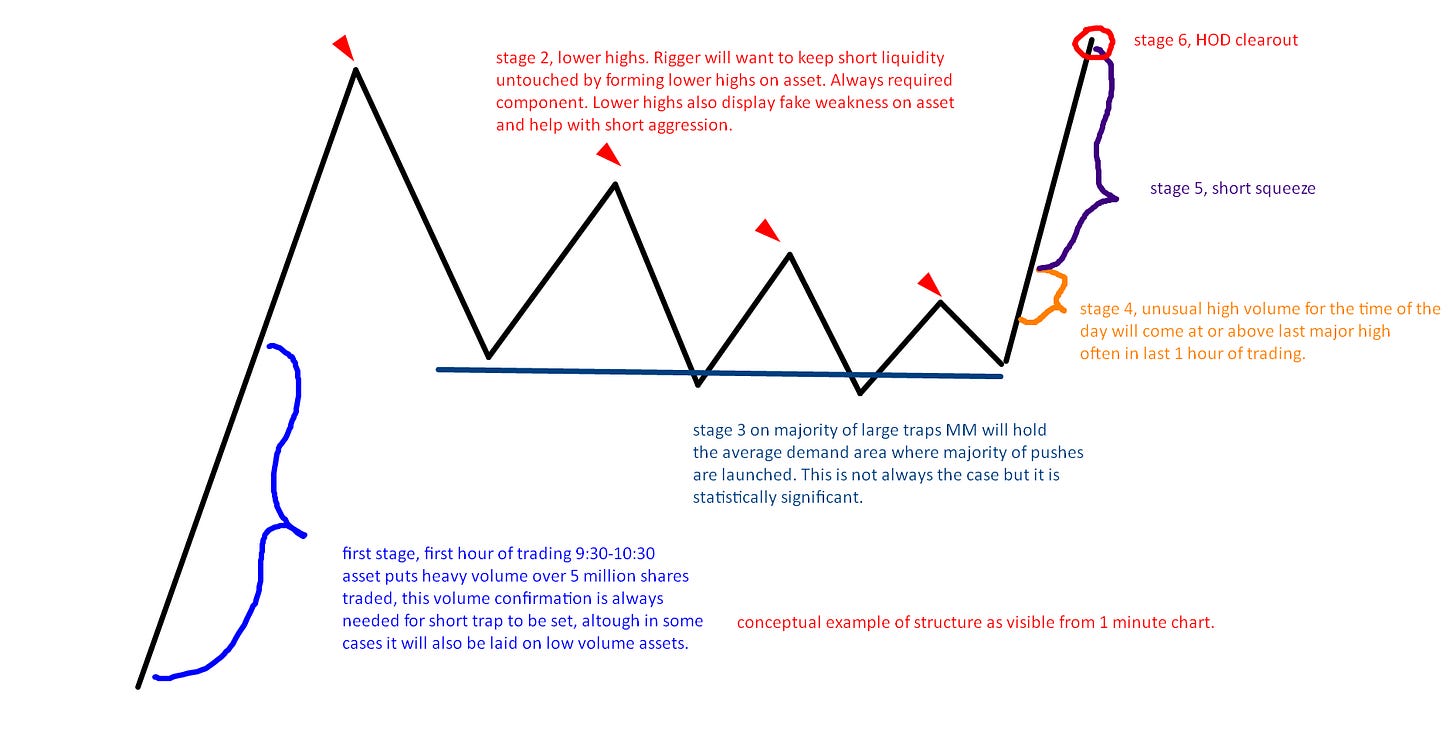

After a year of trial and error, I landed on a setup that consistently worked: TradetheMatrix’s Type 1 setup. The strategy hinges on understanding how market makers and hedge funds manipulate low-float stocks (typically under 10 million shares). They start by aggressively pumping the stock to lure in retail buyers and short sellers. Then they feign weakness to bait more shorts, only to trigger a violent squeeze by pushing the stock to new highs, liquidating the shorts.

Once that liquidity event is over, the stock often fades for the rest of the day. The manipulators have exited, there’s no one left to prop up price, and gravity takes over. This setup became my bread and butter, a classic fade play on equities engineered for a single pump-and-dump cycle. This all-day-fade presents amazing short opportunities for the day trader.

If you’re interested in learning more about this play, Trade the Matrix has written about it extensively on his blog.

Cycles within cycles

I backtested this setup for months and built strong conviction around it. At first, the results were amazing. I’d be profitable for a month or two, only to suddenly hit a string of losses in the following months. It made no sense. I was applying the same strategy, the same rules, yet getting completely different results.

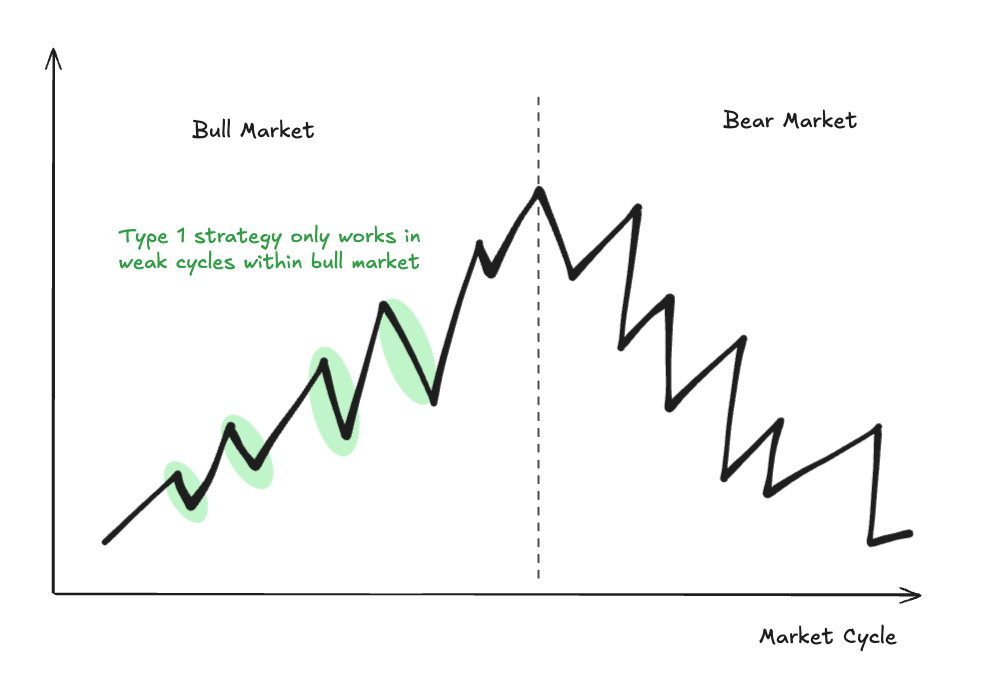

This turned out to be the most important lesson of my day trading career: not all market environments are created equal. There are strong cycles and weak cycles, and my strategy only worked during the weak ones. Within any broader bull or bear market, there are micro-cycles. What works in one phase simply won’t in another. My setup, being a fade strategy, thrived when the market was indecisive or fading momentum. It failed when the tape was too strong.

Recognizing this was a paradigm shift. It taught me that every strategy has a season, and trying to force a trade outside its season is how you get wrecked. This mindset applies well beyond trading - there are seasons in life, careers, and investments. Timing matters more than most people realize, and in reality, you only trade in a super short window. The rest of the time, inaction is the best form of action.

Results

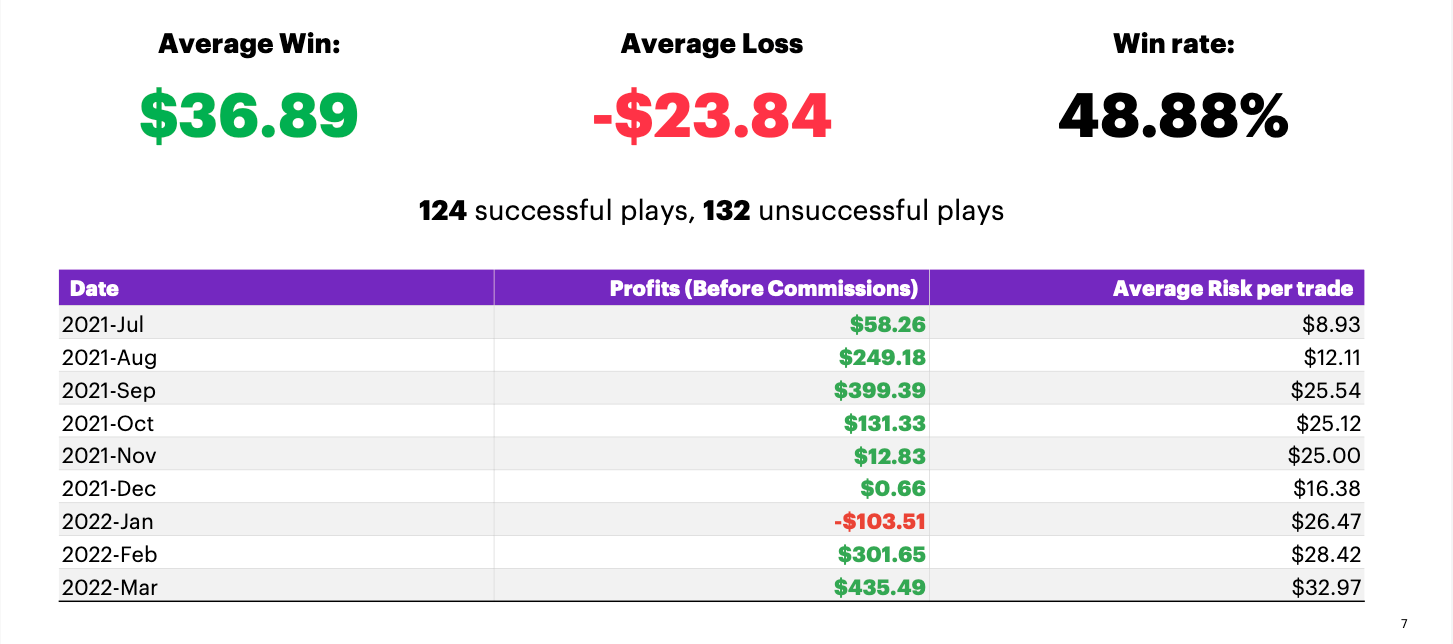

Here are my stats after 9 months of trading this setup, proof that the strategy worked. I kept position sizes small to validate the edge before scaling up.

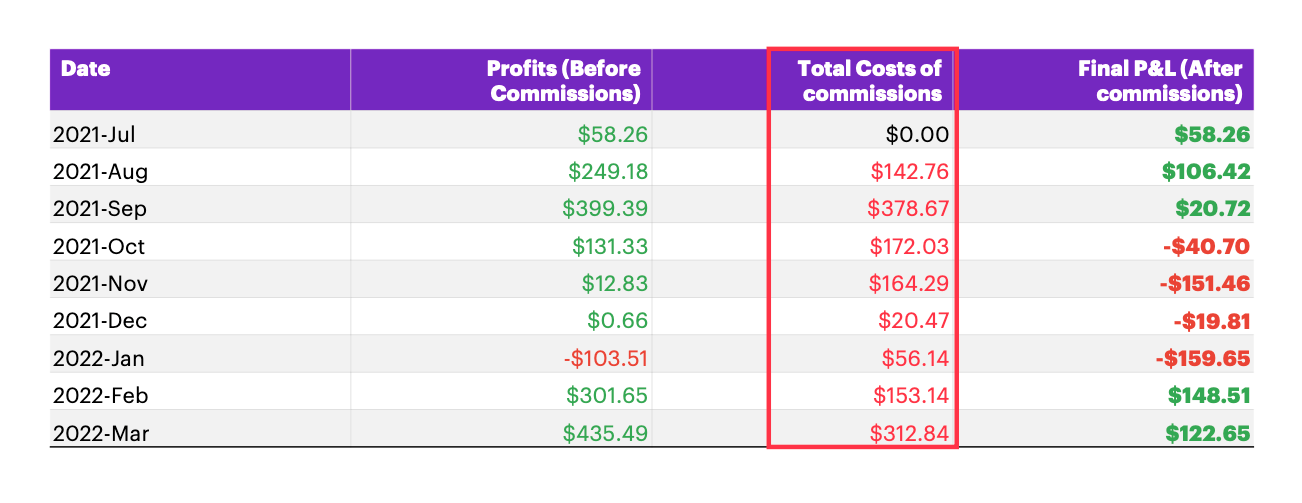

At the time, I thought, damn, I’ve cracked it. I was in the top 1% of traders who actually had a statistically backtested strategy that delivered results. But here’s the catch: the house always wins. The commissions were brutal. In a gold rush, the ones who get rich are the ones selling shovels.

Even though the strategy was profitable, the short borrow fees and brokerage commissions slowly bled me dry. In order to short small float stocks, you often need to borrow shares, and those fees are steep. Over time, they eroded my edge and flipped my PnL into the red.

In the end, I had an edge, just not a big enough one. And time ran out. I had the freedom to explore this in college, but once I graduated and started working, that window closed. The strategy worked, but I had to move on.

Conclusion

I’ve come to realise that the only real way to win is through long-term investing. Short-term price action can be manipulated, but in the long run, the trend asserts itself.

Day trading is possible, but it demands too much. It’s precision work, leaving no room for error. That said, if the day ever comes when shorting stocks becomes free, I might revisit the strategy just for fun.

Investing is like planting a tree and taking a nap. Day trading is more like juggling flaming torches in front of a sadistic queen. One slip and it’s off with your head.

Hopefully, the lessons above offer something valuable, even if just a cautionary tale.

Disclaimer: The content on this Substack is for informational and educational purposes only and should not be considered financial advice. Nothing here constitutes investment recommendations, and you should always conduct your own research or consult a professional before making financial decisions.