Uncertainty

Schrödinger's cat is a famous thought experiment in physics, used to illustrate uncertainty. Until the box is opened, the cat inside is considered both alive and dead. It exists in two states at once. Only when observed does reality “collapse” into one outcome.

Bitcoin today feels like that sealed box. It exists in a kind of limbo. On one side, the story is seductive: the era of the perpetual bid. Institutional capital is pouring in. Spot ETFs are live. Corporate treasuries are accumulating. Asset managers are allocating, not speculating. In this future, Bitcoin behaves like a maturing macro asset. It doesn't crash 80%. It just goes up, slowly and constantly. No more euphoria, no more despair. Just a steady grind as capital flows in and stays.

But the old cycle still breathes. For over a decade, the halving has been Bitcoin’s metronome. The 4-year cycle, a sequence of parabolic tops and brutal resets, remains crypto’s most reliable pattern. Halvings still trigger supply shocks. Retail still FOMOs in late and gets wiped out. While new forces obscure the pattern, the underlying rhythm holds.

Until this cycle plays out, we won’t know if the old model is truly dead or just disguised. Let’s take a look at both perspectives.

A new era

The ETF Revolution

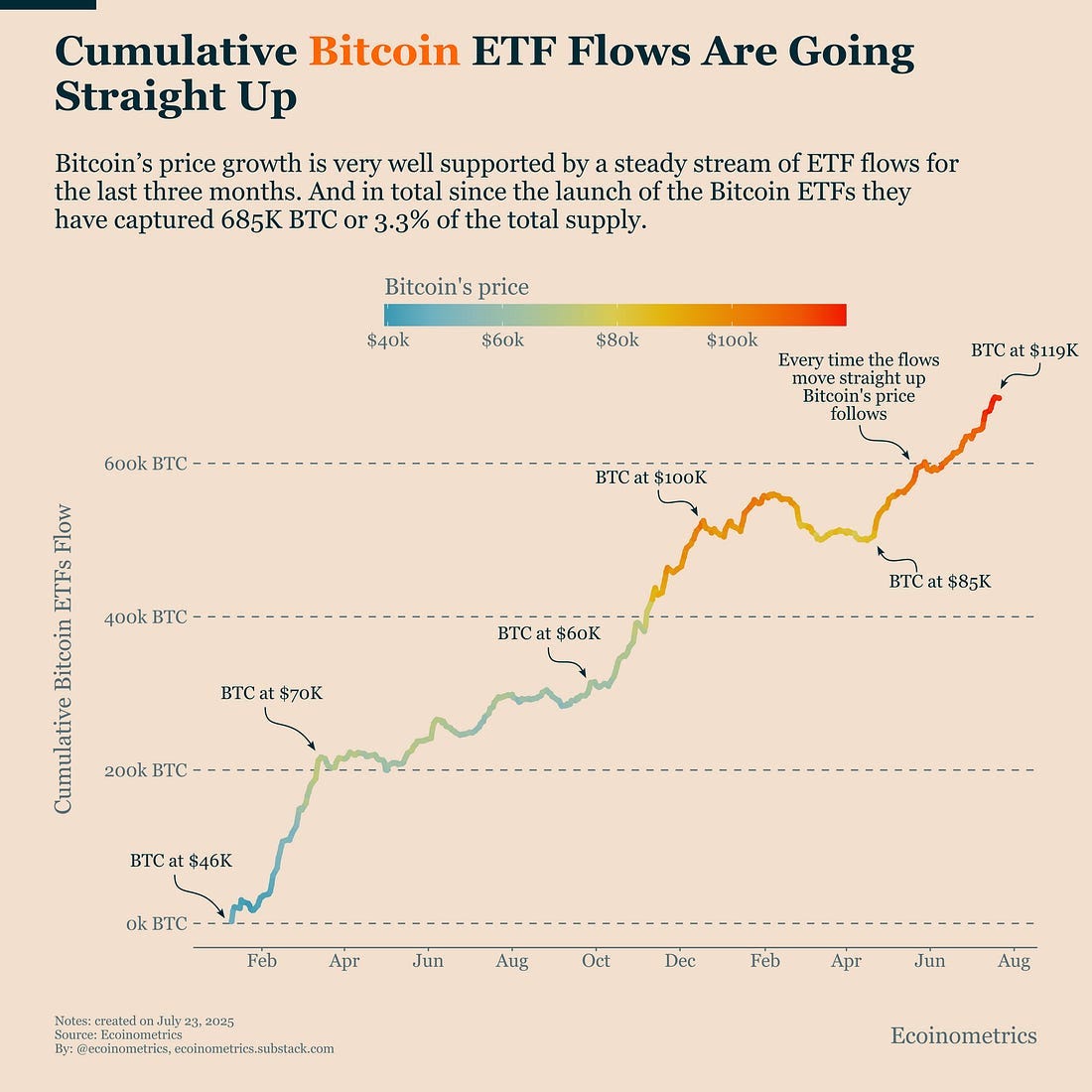

The game has fundamentally changed. Institutions are here, and they're not leaving. BlackRock and the largest asset allocators on the planet have entered the Bitcoin ETF arena, introducing unprecedented institutional demand that dwarfs anything we've seen before.

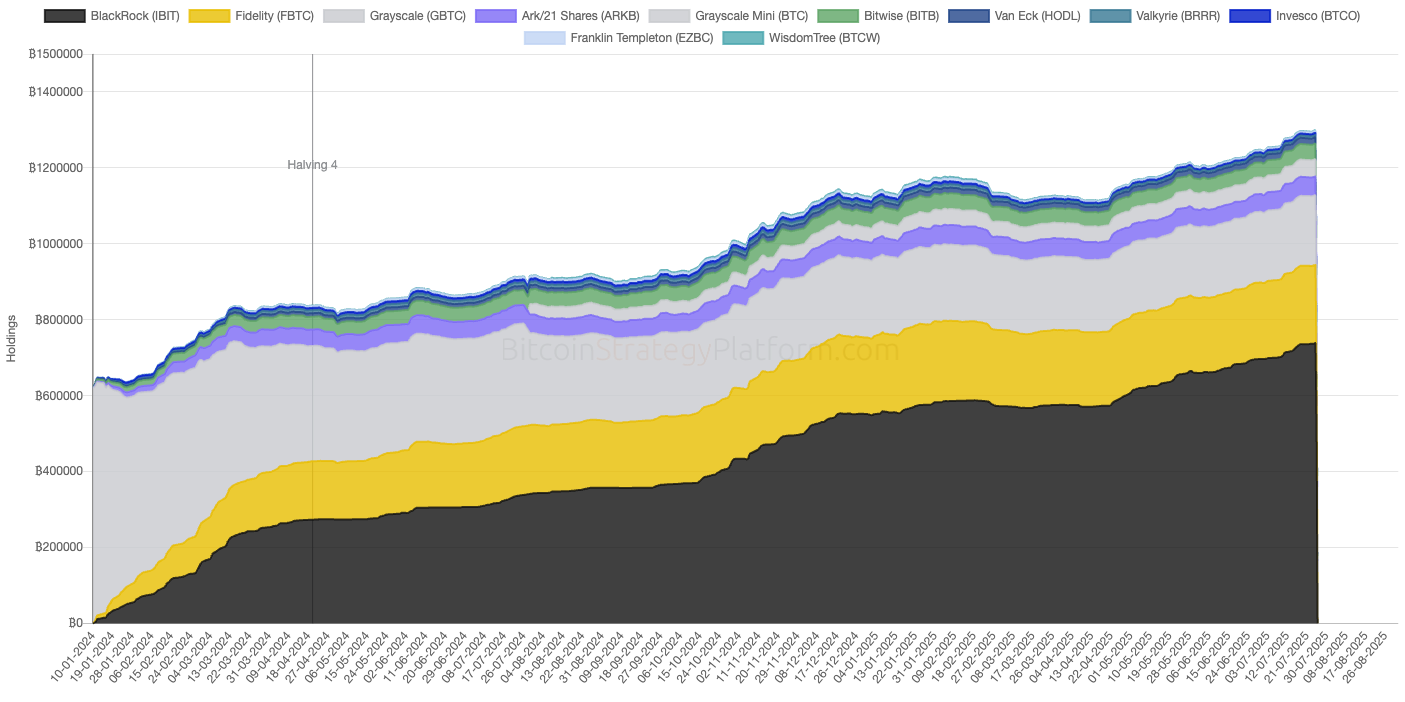

The numbers are staggering. In just one year since the approval and launch of Bitcoin ETFs in the US, major institutions have accumulated 1,298,155 bitcoins. BlackRock alone has amassed 738,006 bitcoin from a standing start, a buying spree that would have been unimaginable just two years ago.

This isn't speculative retail money chasing quick gains. These are the world's most sophisticated asset managers, methodically accumulating what they clearly view as a permanent addition to their portfolios. They know something is up. With only 21 million bitcoin ever to exist (and an estimated 4-5 million already lost forever) the supply equation has never been more compelling.

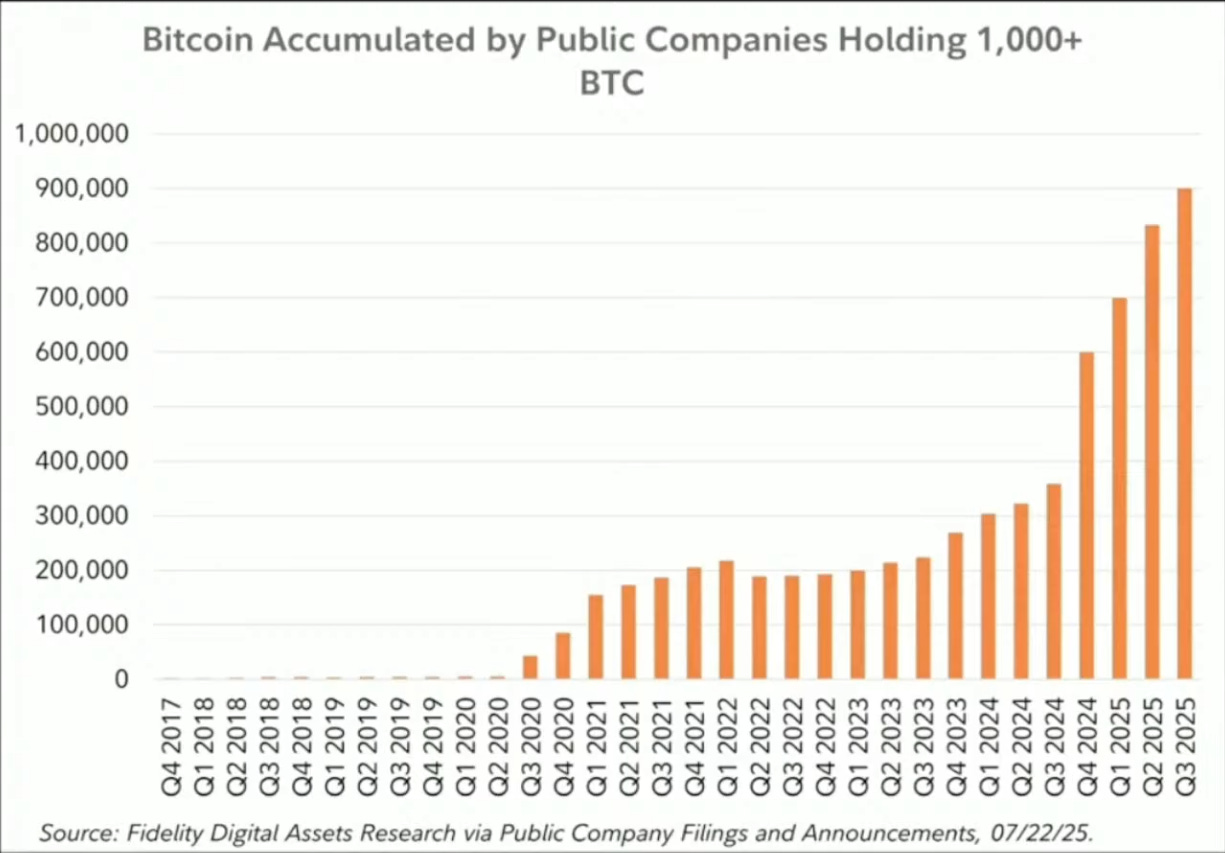

Corporate Treasuries: The New Hodlers

Parallel to the ETF revolution, a quiet transformation is occurring in corporate boardrooms. Companies are abandoning the traditional playbook of holding cash and instead embracing Bitcoin as a treasury asset. Their thesis is simple but powerful: as fiat currencies continue to devalue through endless money printing, Bitcoin's programmed scarcity makes it the superior store of value.

MicroStrategy exemplifies this new paradigm. The company has accumulated 607,770 bitcoin and shows no signs of stopping. Their strategy borders on financial alchemy: issue shares and bonds to investors, use the proceeds to buy Bitcoin, watch the company's fair value increase as Bitcoin appreciates, then issue more shares at higher prices to buy even more Bitcoin. It's a self-reinforcing flywheel that could theoretically continue indefinitely.

Critics call it a Ponzi scheme destined to collapse. But the math tells a different story. MicroStrategy's average purchase price is so low that Bitcoin would need to fall to approximately 16,500, an 86% drop before the company faces insolvency. At this point, such a catastrophic drop seems increasingly unlikely.

Companies like Metaplanet have joined this movement, publicly committing to never sell their Bitcoin holdings. This creates a new class of permanent holders whose buying pressure is structural, not cyclical.

This time it’s different

The chart patterns tell the story. Gone are the violent, retail-driven parabolic moves of previous cycles. Instead, we see something unprecedented: a steady, institutional bid creating smooth, channel-bound price appreciation. When Bitcoin was a small, niche asset, retail traders could easily push prices into euphoric bubbles. But as a multi-trillion-dollar asset class, it now requires institutional-scale capital to move the needle.

The buying is methodical, patient, and relentless. This isn't the frenzied speculation of past cycles, it's the measured accumulation of long-term institutional capital.

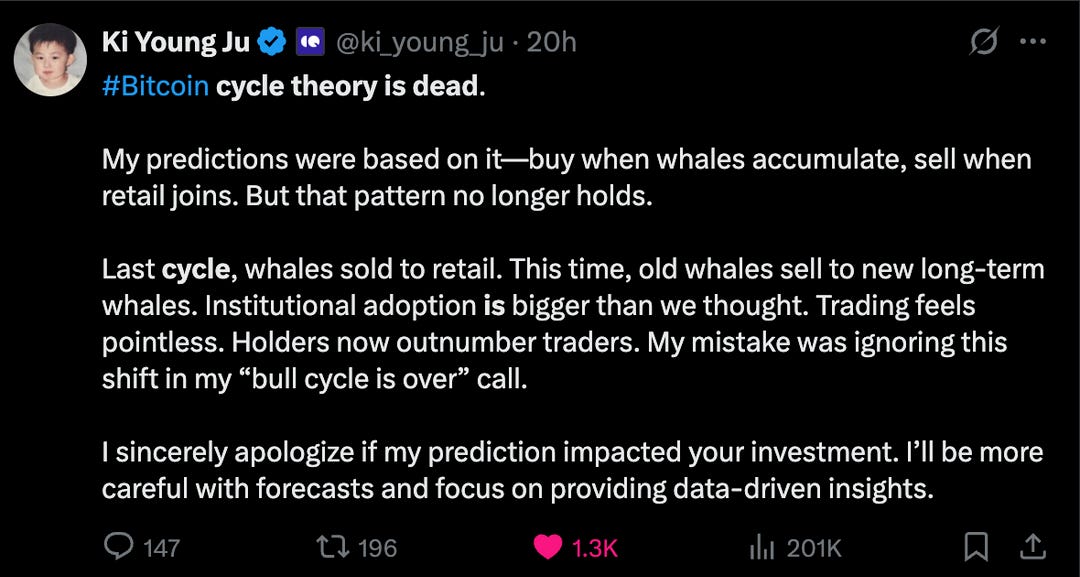

Even prominent analysts are taking notice. CryptoQuant CEO Ki Young Ju recently declared the Bitcoin cycle theory "dead," admitting his whale-based price predictions failed to account for the scale of institutional adoption. The new regime, he notes, is characterized by old whales selling to new long-term institutional holders, a fundamental shift in market structure.

The Gold parallel

History offers a compelling precedent. The pivotal moment that drove investors to gold was the "Nixon Shock" of August 15, 1971, when President Nixon unilaterally severed the U.S. dollar's direct convertibility to gold. This act effectively ended the Bretton Woods system, where the dollar was pegged to gold at $35 an ounce.

Faced with soaring inflation, geopolitical instability, and a devaluing dollar, investors flocked to gold as a safe-haven asset. The result was a massive bull market that saw gold surge from $35 - $850, a staggering 2,300% increase.

If Bitcoin is truly digital gold, we may be witnessing a similar inflection point.

The parallels are striking. U.S. debt has ballooned to $37 trillion, a sum everyone knows can never be repaid through conventional means. The money printer is working overtime, and with interest rates expected to fall by year's end, monetary debasement will only accelerate.

Just as investors fled to gold in 1971, today's institutions are fleeing to Bitcoin. The difference is scale and sophistication. Where gold's 1970s bull market was driven primarily by individual investors and smaller institutions, Bitcoin's institutional adoption involves the world's largest asset managers deploying unprecedented capital.

If this structural bid continues, if institutions keep treating Bitcoin as a permanent portfolio allocation rather than a speculative trade, we could be entering a prolonged period of "up only" for Bitcoin. Such a scenario would fundamentally destroy the classic 4-year cycle, replacing boom-bust volatility with steady, inexorable appreciation.

The 4-year cycle remains

The more things change, the more they stay the same

But let’s look at the other side. Every cycle, people say “this time is different.” Each time, they’ve been wrong.

There’s a kind of idiotic brilliance to the 4-year cycle. It’s boring. It’s simple. But it works. And every time you try to be clever, it humbles you.

Ask yourself: what are the constants that remain despite all this change? Human psychology. Greed, fear, euphoria, and panic. These forces don’t go away. As long as they exist, there will be booms and busts. Smart money will sell into retail FOMO. The price will collapse, as it always has.

Maybe this is a supercycle. Maybe it will run longer. But mean reversion always comes. What goes up must correct.

Famous last words: “This time it’s different”

Throughout Bitcoin’s history, pundits have called for permanent bull markets. Each time, they’ve been proven wrong.

In 2017, Tom Lee predicted $55,000 by 2022. John McAfee bet $1 million by 2020. Bitcoin crashed 83% from $19,303 to $3,200.

In 2020–21, analysts like Dan Held called for a “supercycle.” JP Morgan said crypto had dealt a “crippling blow” to gold. Then Bitcoin dropped 77% from $69,000 to $15,500.

In 2022, the Luna Foundation bought 80,000 BTC as reserves. Commentators said it created permanent demand. The ecosystem imploded, dumping nearly all its holdings.

The best strategies are often boring. Just stack sats. Stick to the cycle. Ignore the noise.

How to play this

We’re faced with two scenarios:

Bitcoin enters a supercycle and grinds higher for years.

The 4-year cycle plays out again: a blowoff top followed by correction.

My plan? I’ll sell 10–20% of my stack in layers as price climbs. I’ll lock in some lifestyle gains, rotate into undervalued assets, and enjoy the ride. But I’ll keep the rest, because I believe in Bitcoin’s long-term future.

I use TradingView models with target levels (7, 8, 9, 10). As each level is hit, I trim a portion. The rest stays untouched. This layered approach keeps me in the trade longer and gives me room to reassess as price evolves. Personally, I avoid selling everything at once, it’s rarely the smartest move.

Conclusion

Ultimately, the choice is yours. Don’t fall for FOMO. Prepare for both outcomes. Build a strategy that wins either way.

Disclaimer: The content on this Substack is for informational and educational purposes only and should not be considered financial advice. Nothing here constitutes investment recommendations, and you should always conduct your own research or consult a professional before making financial decisions.