The Bull Case for MicroStrategy

Unlocking infinite money using bitcoin and bonds

The Infinite Money Glitch

Of all the wild things to happen in the stock market over the past century, what Michael Saylor is doing at MicroStrategy may go down as the most audacious and ingenious move in financial history.

Saylor has managed to acquire billions in Bitcoin using almost no company funds, borrowing at close to 0% interest. By masterfully combining share dilution and convertible debt, he’s flipped conventional finance on its head — creating what some now call the “infinite money glitch.”

This is financial alchemy at its finest. Let’s break down how it works — simply and clearly.

The Mechanics of Dilution

Before we dive into Saylor’s company, it’s easier to grasp the brilliance of the strategy through a simple hypothetical example.

Imagine a public company called Degen Inc. that owns $8,000 worth of Bitcoin and has 1,000 shares outstanding. Each share represents $8 of Bitcoin.

If Degen Inc. is in a tight spot and needs cash to pay employees, it can choose to issue another 1,000 shares. In this case, the total share count doubles to 2,000, but the Bitcoin holdings stay the same. Each share would now only represent just $4 of Bitcoin.

This is a textbook case of dilution — more slices, same pie. In traditional finance, it’s seen as bearish because it reduces the value each shareholder gets. Existing investors of Degen Inc. now own less bitcoin per share, and would rightfully be pissed off.

Accretive Magic: When Dilution Becomes a Good Thing

Now imagine Degen Inc.’s stock trades at $10 — a premium to its $8 fair value. The company issues 500 new shares at $10 each, raising $5,000, and uses the entire amount to buy more bitcoin.

At first glance, this might look dilutive. But do the math: Degen Inc. now holds $13,000 worth of Bitcoin and has 1,500 shares outstanding. That’s $8.67 of Bitcoin per share, up from $8 before.

In other words, by issuing shares at a premium and using the proceeds to buy more Bitcoin, Degen Inc. increased the value per share. This is called accretive dilution — shareholders are diluted, but their claim on assets grows.

It only works when new shares are sold above fair value. Issue at $8, and the asset-per-share stays flat. Issue below $8, and you dilute in the traditional, value-destructive sense.

This is an absolute mind fuck.

As the owner of Degen Inc., I can keep issuing new shares when the stock is trading above fair value and use the proceeds to buy hard assets. My shareholders don’t complain, because the value of assets per share actually goes up.

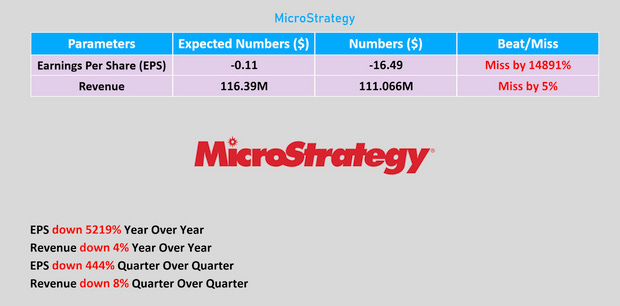

MicroStrategy

This is exactly what MicroStrategy is doing. Michael Saylor realized that he could repeat the loop endlessly — issuing shares or debt, buying more Bitcoin, and letting market demand do the heavy lifting. In effect, he’s stacking the hardest, scarcest asset on Earth out of thin air.

MicroStrategy now holds 555,450 bitcoin, acquired by converting its entire cash reserve into BTC and financing the rest through debt. At current prices, that stash is worth $58 billion.

By accumulating so much bitcoin, Saylor turned MicroStrategy into a leveraged bitcoin proxy:

If Bitcoin goes up 10%, MicroStrategy might rally 20–30%.

If Bitcoin drops 10%, MSTR typically falls even harder.

At this point, the underlying business is irrelevant. No one’s buying the stock for business intelligence software — they’re buying it for pure bitcoin exposure, on steroids.

The market understands this. Even though MicroStrategy’s core business has consistently underperformed traditional financial benchmarks, MSTR has crushed nearly all major tech stocks and outpaced key indices.

This should absolutely blow your mind. Imagine being such a giga-chad that you make 1,300% returns on your stock thanks to bitcoin, and no one actually cares about your underlying business that is actively losing money.

Convertible Bonds

The next layer of this financial wizardry involves convertible bonds. These are debt instruments that can be converted into equity if the stock price reaches a certain level.

Here’s how it works:

MicroStrategy borrows money with very low or even 0% interest rates to buy bitcoin.

Investors buy these bonds because they include the option to convert into MicroStrategy stock if it skyrockets.

If the stock soars past a set threshold, bondholders convert the debt into shares, often at a discounted price.

Saylor never has to repay the debt in cash — the bonds effectively disappear and become equity.

Shareholders are happy for the stock dilution if the bonds convert into equity because they now own more bitcoins per share.

In 2020, MicroStrategy raised $650 million in convertible debt at 0.75% interest. In 2021, they raised another $1.05 billion at 0% interest. In 2024, they raised $3 billion in 0% convertibles again. All of this money went straight into Bitcoin purchases.

Why are investors so eager? Because traditional bonds offer paltry 3-5% returns. In contrast, Saylor’s bonds offer the potential to double or triple their investment if the stock surges. These instruments turn bonds — historically conservative, yield-bearing assets — into lottery tickets with asymmetric upside.

Wall Street loves this play because many institutions are restricted from buying risky assets like bitcoin directly. MSTR bonds offer a backdoor — exposure to Bitcoin’s upside in a compliant, fixed-income wrapper. Unsurprisingly, every issuance is oversubscribed.

Bitcoin Treasuries

MicroStrategy didn’t just rewrite its own destiny — it sparked a movement. Since Saylor’s pivot, a growing list of public companies, private firms, and even nation-states have begun imitating his Bitcoin treasury strategy.

This isn’t just imitation — it’s competitive accumulation. These entities are racing to grab as much Bitcoin as possible, and in doing so, they’re driving up demand for a fixed-supply asset.

That’s incredibly bullish for two reasons:

It fuels Bitcoin’s price — every corporate buy shrinks the available float and reinforces the store-of-value narrative while bidding up price.

It strengthens MSTR’s position — no matter how many imitators emerge, MicroStrategy remains the largest corporate holder of bitcoin on Earth. With supply capped at 21 million and demand accelerating, their massive stack is like sitting on a digital oil field.

Think about it, no one else has the firepower to acquire over 500,000 BTC — Saylor moved early, buying when bitcoin was cheap and the world wasn’t watching. Now that BTC trades above $100K, building a similar position is nearly impossible.

The next closest competitor isn’t even in the same league. MSTR has entrenched itself as bitcoin’s institutional apex predator — and there’s no catching up.

In short, MicroStrategy didn’t just front-run the next wave of capital — it triggered it. And the more copycats enter the game, the more MSTR and bitcoin benefit.

This is financial alchemy at its finest.

Conclusion

MicroStrategy isn’t just a tech company anymore — it’s a high-voltage bitcoin accumulator wrapped in a public equity. Through relentless execution, financial engineering, and perfect timing, Michael Saylor has turned MSTR into the ultimate leveraged bet on digital gold. As long as bitcoin rises, MicroStrategy doesn’t just ride the wave — it amplifies it. And with over half a million BTC locked up, the game is no longer about catching up. It’s about watching the king defend his throne.